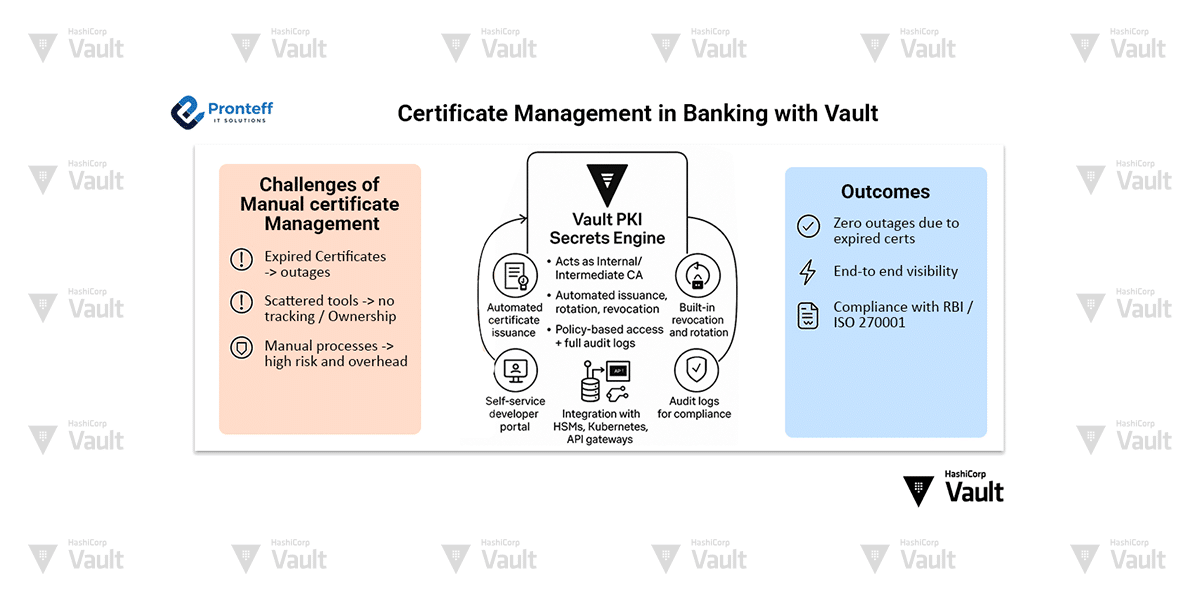

Certificate Management in Banking with Vault

In this blog, we will learn about certificate management in Banking with a vault.

Introduction

In today’s rapidly evolving banking landscape, secure communication between systems, applications, and third-party services is not optional – it’s a regulatory necessity. Certificates are at the heart of this trust, enabling encrypted communication and identity verification. Manually handling certificates or relying on scattered tools often leads to issues like expired credentials, poor visibility, and weak accountability. Vault simplifies certificate handling in financial institutions by offering centralized, automated lifecycle management.

Why it is Critical in Banks

Banks rely on a complex web of services that demand secure, authenticated connections:

- APIs connecting to partners, regulators, and fintechs

- Internal microservices and legacy systems communicating over TLS

- Customer-facing applications that must validate identity

- Encrypted communication across branches and cloud environments

Manual certificate handling often results in:

- Expired certificates leading to outages

- Poor visibility into certificate ownership and usage

- Non-compliance with RBI and global security standards

- High operational overhead

HashiCorp Vault PKI Secrets Engine:

Key Capabilities

Vault’s PKI (Public Key Infrastructure) secrets engine helps banks overcome these challenges by acting as an internal Certificate Authority (CA) or an intermediate CA. Here’s how it helps:

- Automated Certificate Issuance

- On-demand issuance of short-lived certificates

- Fully auditable and policy-governed

- Built-in Revocation & Rotation

- Certificates can be automatically revoked on expiry or via API

- Short TTL (Time-To-Live) ensures tighter control

- Self-Service Developer Portal

- Teams can request certificates with approved roles and templates

- Reduces dependency on IT operations

- Audit Logging for Compliance

- Every issuance and revocation is logged

- Aligns with RBI guidelines and ISO 27001 practices

- Integrations with Banking Infrastructure

- Integrate with HSMs, Kubernetes, Service Mesh (like Istio)

- Support for dynamic secrets tied to certificates

Sample Use Case: Securing API Gateways and Core Banking Integrations.

Imagine a scenario where a bank exposes APIs to partners and internal apps via an API Gateway. Each service requires a TLS certificate:

- Vault acts as the internal CA and provisions certificates for each API endpoint

- Certificates are automatically rotated every 3 days

- Once a certificate expires, it is replaced and deactivated through a fully automated process.

- Developers access the Vault UI or CLI to request new certs during CI/CD deployments

This results in:

- No outages due to expired certs

- Complete visibility into certificate usage

- Full audit trail for every certificate issued

How Vault Adds Value in a Regulated Industry

- Security First: Zero trust architecture with strong identity-based access

- Automation: Eliminates manual errors, increases DevOps velocity

- Compliance-Ready: Proves controls with detailed audit logs

- Scalability: Works across on-prem, hybrid, and cloud banking ecosystems

Conclusion

Banks are under increasing pressure to secure every endpoint, every API, and every communication channel. HashiCorp Vault enables IT and security teams to automate certificate management while maintaining full control. For banks embracing digital transformation, Vault is not just a secrets store – it’s a cornerstone of secure infrastructure.

Next Steps

Interested in a hands-on demo or pilot tailored for your banking environment? Reach out to our Vault experts today and start automating certificate management with confidence.

Pronteff, a certified HashiCorp Vault partner, works with major banks and financial institutions across India.