Strategic Benefits of Vault for Indian Banks

In this blog, we are going to learn about the strategic benefits of Vault for Indian Banks.

Regulatory Pressures on Banks

Indian banks are under stricter scrutiny than ever before. Regulations demand:

- No hard-coded secrets in applications

- Automated rotation of passwords, keys, and certificates

- Centralized governance with immutable audit logs

- DR readiness with auditable evidence

Failure leads to:

- RBI observations and penalties

- PCI-DSS/UIDAI non-compliance fines

- Loss of customer trust after outages

Strategic Benefits with Vault

- Regulatory Compliance

| Requirement | Vault Capability |

|---|---|

| RBI mandates | No hard-coded secrets, auto-rotation |

| PCI-DSS audits | Encrypted storage, short-lived credentials |

| UIDAI & ISO audits | Centralized governance & reporting |

Vault acts as a compliance accelerator, providing audit-friendly evidence out of the box.

- Operational Efficiency & Cost Savings

| Pain Point | Traditional Cost | Vault Advantage |

|---|---|---|

| Manual certificate tracking | Risk of outages costing crores | Automated renewal prevents downtime |

| DBA credential resets | Hours wasted monthly | Dynamic secrets save manpower |

| Siloed tools (CLMS, HSM, Oracle Vault) | High license & infra costs | Unified Vault platform reduces duplication |

Vault adoption translates into faster go-to-market for new digital services.

- Risk Reduction & Security

- Static passwords removed → reduces insider & external leakage risk

- Keys never leave Vault → stronger control over encryption lifecycle

- Immutable logs → accountability for every secret access

Banks improve their cyber-resilience posture and meet RBI’s risk-based supervision expectations.

- Centralized Governance & Audit Readiness

- Single control plane for secrets, keys, and certificates

- Role-based access policies ensuring segregation of duties

- Audit logs that satisfy both internal IS audits and RBI inspections

Vault turns audits from a 3-week exercise into a 3-hour evidence export.

- Business Continuity & Future-Readiness

- HA + DR Replication ensures business continuity during outages

- Scales with APIs, fintech partnerships, OpenShift adoption, and cloud migration

- Aligns with peer banks already adopting Vault → prevents competitive disadvantage

Why IBM + HashiCorp Vault?

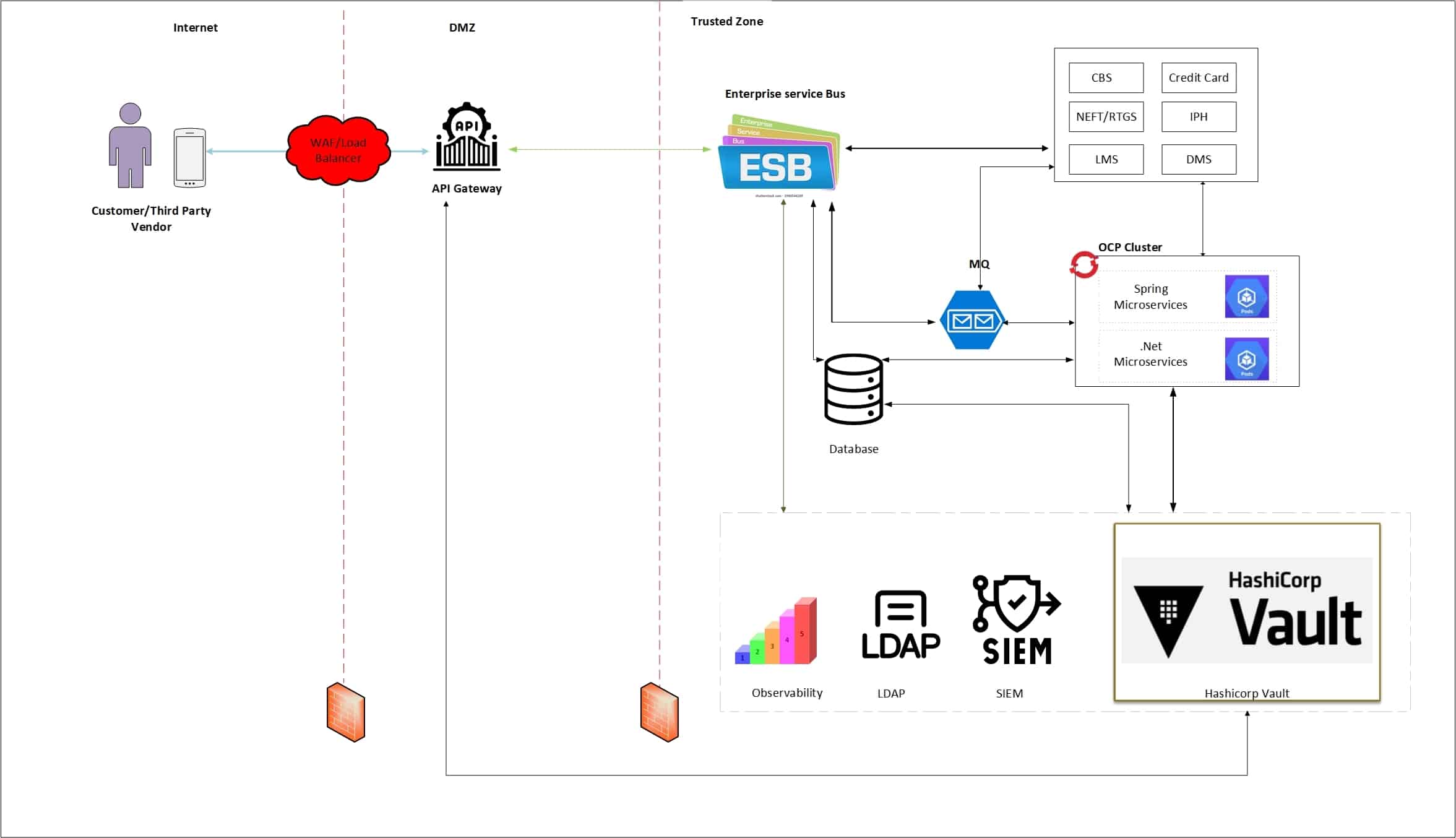

- IBM brings integration expertise across Core Banking, OpenShift, Middleware (MQ, IIB), and API Security

- HashiCorp Vault provides the trusted secrets platform for banks worldwide

- Together, they deliver a secure, compliant, and future-ready foundation for Indian banks

CXO Takeaway

For bank leaders, Vault is not just an IT upgrade. It is:

- A compliance guarantee against RBI, PCI-DSS, UIDAI standards

- A cost optimization tool reducing duplicate systems & outages

- A future-proof enabler of open banking, fintech partnerships, and digital transformation