Integration of IBM MQ with FedNow Service

Here in this blog, we are going to learn about integration of IBM MQ with FedNow service

Let’s together start integrating IBM MQ with the FedNow service

The features of the FedNow service represent a significant advancement in the realm of payments, offering speed, security, and accessibility to both financial institutions and end users alike asynchronously using IBM MQ.

Real-time settlement

The FedNow Service allows participating financial institutions (FIs) to settle funds instantly, eliminating the need for delayed settlement periods. This real-time settlement feature ensures that transactions are completed promptly and securely.

Interbank obligations elimination

With FedNow, there is no accumulation of interbank obligations, as funds settle immediately between participating FIs. This helps in streamlining the payment process and reducing the complexity associated with traditional settlement methods.

Mitigation of short-term credit risk

Since transactions settle in real-time, there is minimal exposure to short-term credit risk for participating FIs. This mitigates the risk of default associated with delayed settlement and enhances overall financial stability within the system.

Immediate access to funds

End users benefit from immediate access to their funds through the FedNow service. Whether making payments or receiving funds, individuals and businesses can enjoy the convenience of instant access to their money without waiting for traditional settlement times

Role of IBM MQ in integrating with the FedNow service

IBM MQ can serve as a reliable and secure messaging middleware for the FedNow service, facilitating real-time communication, settlement and risk management between participating financial institutions.

IBM MQ can ensure that messages related to payment instructions, confirmations and acknowledgments are exchanged between participating financial institutions (FIs) in real-time, enabling instant payment processing regardless of the time of day and serve as the communication backbone for the FedNow interface, allowing participating FIs or their service providers to exchange messages related to reports, queries, and configurations seamlessly.

IBM MQ can encrypt all data flows between FIs and the FedNow service, ensuring the confidentiality and integrity of sensitive payment information. Additionally, features for message integrity and data security can be implemented using IBM MQ’s capabilities

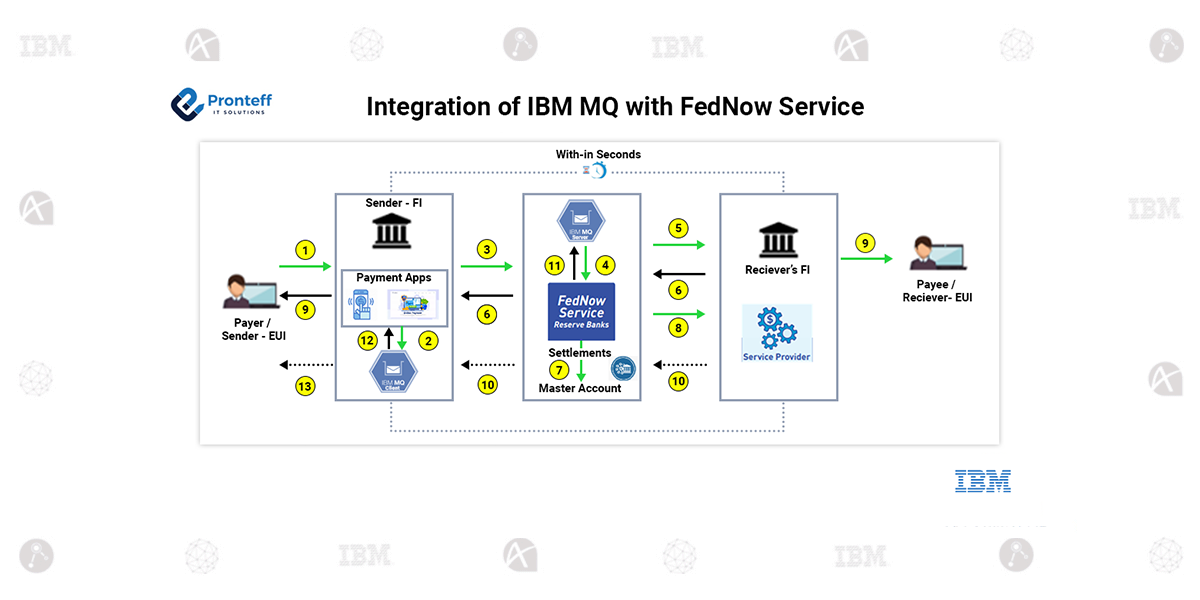

Payment flow

The following end-to-end flow demonstrates how IBM MQ can seamlessly integrate into the FedNow service, providing secure and efficient messaging infrastructure to facilitate real-time payments between financial institutions and ensure a smooth payment experience for end users.

Point 1:

Payment initiation:

The sender (an individual or business) initiates a payment with their FI through an end-user interface outside of the FedNow service. The FedNow sender FI is responsible for validating the payment according to its internal processes and requirements.

Point 2:

The sender FI submits a payment message (ISO® message pacs.008) to the IBM MQ client.

Point 3:

IBM MQ client perform PUT / GET operations according to the requirement.

Point 4:

The FedNow service reads ISO Message from IBM MQ server validates the payment message — for example, by verifying that the message meets proper format specifications and complies with applicable controls

Point 5:

The FedNow service sends the contents of the payment message to the recipient’s FI to seek confirmation that the receiver FI intends to accept the payment message. At this point, the receiver FI will determine how it will handle the message (accept, reject or accept without posting (ACWP)). Among other things, the receiver FI should use this step to ascertain whether it maintains an account for the recipient identified in the contents of the payment message.

Point 6:

Confirmation:

In this example flow, the receiver FI sends a positive response of “accept” to the FedNow service, confirming it intends to accept the payment message. Note: Steps 5 and 6 are intended to reduce the number of misdirected payments and resulting exception cases that can occur in high-volume systems.

Point 7:

The FedNow Service settles the payment, debiting and crediting the designated master accounts of the sender FI and receiver FI (or of their correspondents), respectively. Steps 3-7 complete within a few seconds but take no more than 20 seconds

Point 8:

The FedNow service sends an advice to the receiver FI and an acknowledgement to the sender FI, executing the payment order and notifying each that the Federal Reserve Banks settled the payment message. Correspondents enabled within a FedNow profile may choose to receive a notification of debit/credit entries (ISO message camt.054).

Point 9:

Funds availability and notification to customer: As a term of participation in the FedNow Service, the Federal Reserve Banks require the Receiver FI to make funds available to the recipient immediately after step 8.

Point 10:

Confirmation of posting:

In general, the Receiver FI has the option of sending a message through the FedNow Service.

Point 11 and 12:

FedNow Service PUTs the message in IBM MQ Server then IBM MQ Clients GETs the message to send it to the Sender FI indicating that the payment has been posted to the recipient’s account.

Point 13:

If the Receiver FI sends a confirmation of posting message through the service, the

Sender FI should notify its customer that the funds have been made available to the recipient

Conclusion

In essence, the integration of IBM MQ into the FedNow Service empowers financial institutions to offer real-time payments with confidence, providing end users with a seamless and secure payment experience. By leveraging IBM MQ’s advanced messaging capabilities, the FedNow Service sets a new standard for speed, security, and reliability in the modern payments landscape.