Using FedNow Service for Collaboration and Innovation

Here in this blog, we are going to learn how to use FedNow Service for collaboration and innovation.

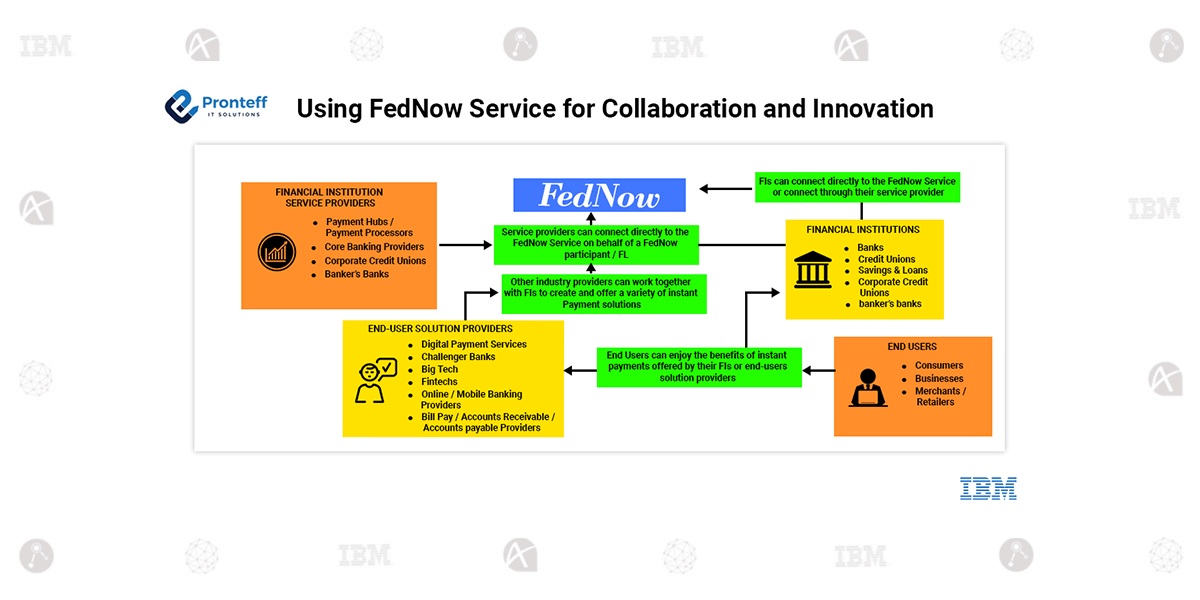

The FedNow Service opens up avenues for collaboration and innovation across various stakeholders in the financial ecosystem. Here’s how different organizations can leverage this new service:

- Financial Institutions (FIs): FIs eligible for Federal Reserve Financial Services can directly connect to the FedNow Service or choose to connect through service providers. They can offer instant payment capabilities to their customers, enhancing customer experience and competitiveness in the market.

- Service Providers: Payment hubs, core banking providers, corporate credit unions, bankers’ banks and other service providers can act as agents for FIs, connecting them to the FedNow Service. These providers play a crucial role in facilitating seamless integration and offering value-added services to FIs.

- End Users: Consumers, businesses, merchants and retailers can enjoy the benefits of instant payments provided by their FIs or end-user solution providers. This enables faster transactions, improved cash flow management and greater convenience in financial interactions.

- End-User Solution Providers: Digital payment services, challenger banks, big tech companies, fintechs, online/mobile banking providers and bill pay/accounts receivable/accounts payable providers can leverage the FedNow Service to offer innovative payment solutions to end users. They can integrate instant payment capabilities into their platforms, driving adoption and engagement among their customer base.

- Other Industry Providers: Beyond FIs and service providers, other industry providers can collaborate with FIs to create and offer a variety of instant payment solutions. This includes technology firms, payment networks, software developers and consulting firms, among others. By leveraging the infrastructure and capabilities of the FedNow Service, these organizations can contribute to the development of innovative payment products and services.

Overall, the FedNow Service serves as a catalyst for collaboration and innovation within the financial industry, enabling stakeholders to deliver faster, more efficient and convenient payment experiences to end users. By working together, FIs, service providers, end-user solution providers and other industry participants can unlock new opportunities and drive the evolution of the payments landscape.