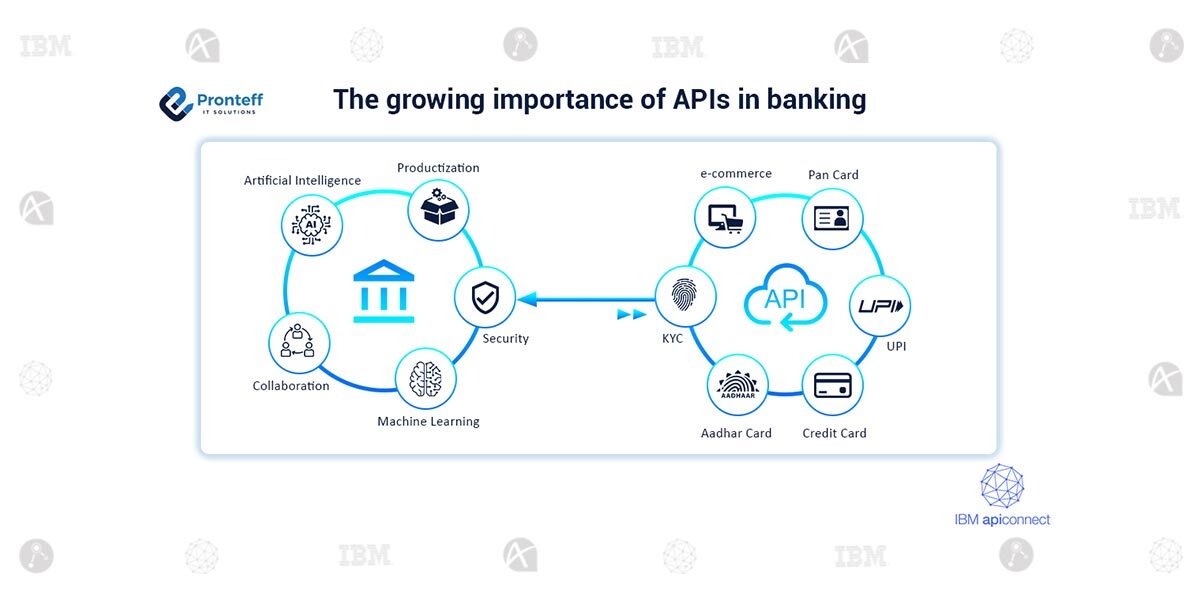

The growing importance of APIs in banking

Given the particular circumstances in which we now find ourselves, digital transformation is essential. It is past time for banks to update their outdated business systems without causing any disruptions, which is a significant problem. APIs, or Application Programming Interfaces, have emerged as a critical facilitator for a painless and risk-free digital transition. An API-led approach to system modernization will enable banks to engage with other fintech firms to embrace current technology while simultaneously boosting security and lowering expenses. API banking, also known as open banking, safeguards the system’s integrity by allowing for controlled and secure access. API banking is a collection of protocols that allows banks to offer their services to other fintech firms via a technical interface between software programs or APIs.

Using APIs to simplify financial services in a variety of ways

An API is a programming interface that allows you to sync and link the service’s database with any other existing application, making data tracking easier and safer. Data tracking has shown to be beneficial in the Fintech industry in terms of combating threat actors, personalizing consumer desires, making efficient use of time, and propelling the fintech business to new heights. Among the many advantages that technology has to offer, security is the most pressing concern. As APIs become more common, the security protections that banks and Fintech companies include in financial systems are becoming increasingly important. Banking technologies are improving security to maintain a sense of confidence with clients while new technologies focused purely on consumer security enter the market.

The open banking and API procedures will also widen the horizon for financial organizations in terms of gaining access to consumer data and features in order to deliver precise remedies. Although it is common knowledge that clients place a great deal of trust in their banks to preserve their personal information, For banks to continue to serve as trusted advisors to their consumers, technological innovation must be properly integrated with security protocols. APIs, or application programming interfaces, help clients get the most out of their financial services by allowing them to share products and form new collaborations.

APIs connect banks and fintech companies so that both can benefit from one another and provide modern solutions to their consumers. APIs are now the proprietary products across the financial sector, and they come with a slew of advantages. Here are the few important ones:

API Banking Security:

Banks must maintain API security, which they may do by working with a reliable and secure partner. A competent API technology partner will have the necessary technology, regulatory awareness, and policies in place to assure tight security. As a result, selecting the correct API partner with the necessary knowledge is crucial for banks to provide a robust API solution while remaining certain that risk is limited and surveillance is used to reduce new dangers as they arise.

Productization:

An API is more than just a back-end service provider in today’s more open financial services industry; it’s also a product that can be monetized and utilized to establish new services. APIs can also be deployed quickly and with minimal back-end refactoring.

Collaboration:

API solutions are becoming more and more popular as a platform for collaboration between banks and fintech companies. API solutions for banks can help older financial institutions discover the right fintech partners to offer their customers innovative solutions. Instead of needing to build new systems from the ground up, APIs can help FinTechs interact more successfully with banks’ old systems.

In API-enabled banking, what role do artificial intelligence and machine learning play?

Another component of digital transformation is incorporating AI. Banks and other businesses may integrate AI capabilities into their existing apps utilizing APIs without the assistance of data scientists or programmers that specialize in AI. Machine Learning (ML) and Artificial Intelligence (AI) are complicated and multidimensional algorithms.API is just one of the many features offered by these apps. It effectively automates a variety of applications, saving a significant amount of time and energy while also providing a plethora of new data streams.

Developing artificial intelligence-based apps is a time-consuming and difficult process, but APIs make it simple and economical, allowing banks to implement all of the necessary security measures at a minimal cost. Although the API used in machine learning applications will vary depending on the industry. APIs, as well as AI and machine learning, are necessary for a banking project to assess the clients’ security concerns. Using an open banking technology platform like API, it’s never easy to assure security. Collaboration with well-known technology businesses is required to maintain the security of financial transactions.

Conclusion

As more fintech firms want to engage with banks, APIs will play a vital role in supporting upcoming fintech companies in effectively integrating with the bank’s legacy systems. As more fintech businesses arise, the demand for banking-specific APIs is expected to grow. APIs for open banking is opening up a slew of new possibilities for a safe banking experience. Integrating APIs into open banking is one of the best options in the present scenario. Keeping up with technological innovation is the only way to stay ahead of the competition in this period, which is why banks and fintech firms are rapidly integrating APIs.