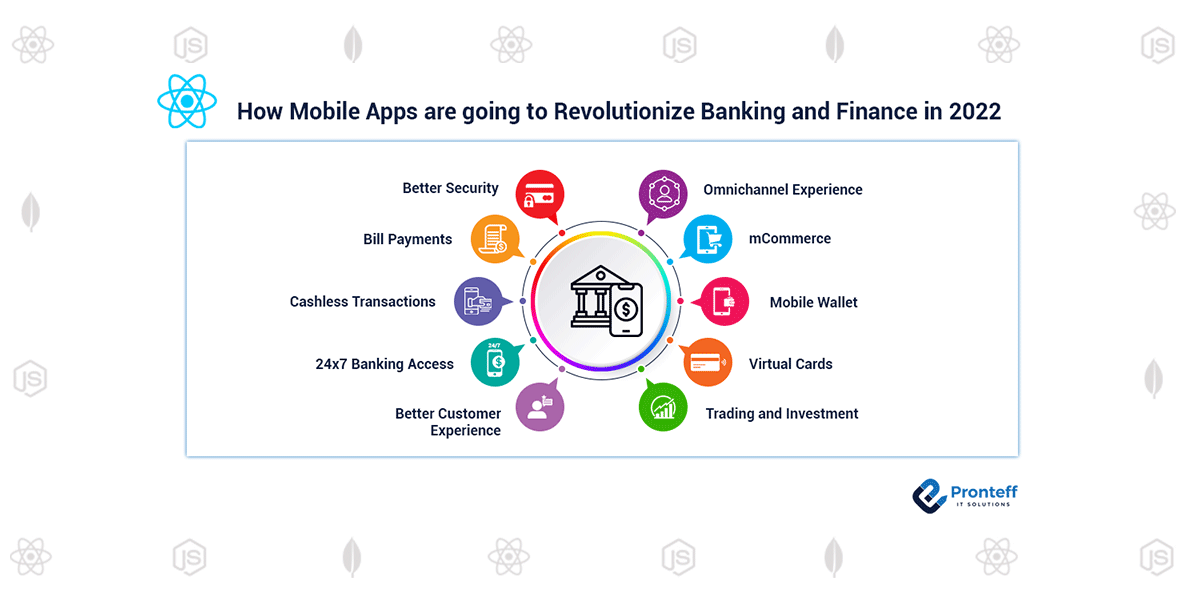

How Mobile Apps are going to Revolutionize Banking and Finance in 2022

Customers have switched from conventional banking to Mobile banking apps as they’re easy to use for regular simple banking activities. According to Statista, 90% of customers inside the US use Mobile banking apps to test their balances, view the latest transactions, pay bills, and make transfers. Instead, the usage of online banking and Finance, an increasing number of customers are switching to mobile apps.

As greater human beings pick Mobile banking there’s an extra in customers’ expectancies. Consumers count on convenience, security, and delivered functions that assist enhance their monetary health. Financial establishments that don’t meet those expectancies danger dropping clients.

Many monetary companies provide compelling Mobile banking experiences. Developing excellent in-app person revel in manner banks can get clients greater engaged with their finances.

1. Better Security

An economic app is part of a bigger atmosphere that consists of banks and different fintech platforms. Sensitive statistics are continuously flowing to and from those structures. Hackers can with no trouble intercept visitors without sturdy infrastructure protection.

Hacking assaults show that easy safety features are inadequate to guarantee a stable consumer experience. You ought to keep in mind enhancing the general protection of your app infrastructure.

For example – Bank of America for consumer pride stands out in protection. They confirm enrollment with a code and additionally offer transaction signals for brand spanking new payees, password adjustments, and different doubtlessly suspicious activities. If the financial institution detects suspicious activity, they may touch clients to confirm transaction activity. Customers aren’t held chargeable for fraudulent Mobile banking transactions.

Security is a massive problem in economic technology, and blockchain can be the trick to making fintech software programs impenetrable. Blockchain-primarily based totally structures can deter centered assaults or reduce the outcomes of a compromise because of their dispensed nature and transparency.

2. Bill Payments

As fintech businesses make investments plenty of cash to lure customers to apply their UPI apps, records from their structures should help banks and different creditors enhance their purchaser lending operations. Fintech collaborations permit banks to increase loans to formerly unexplored patron classes with the aid of using strengthening underwriting methods with transaction records provided with the aid of using price applications.

3. Cashless Transactions

E-wallets have to grow to be a whole lot extra famous as a method of decreasing transaction times. To make transactions extra frictionless, e-trade firms and all online marketplaces have connected Mobile wallets. Since the arrival of UPI, it has grown to be a whole lot less difficult due to the fact the switch is made immediately from the financial institution account as opposed to a wallet.

4. 24×7 Banking Access

The advantage of the usage of Mobile apps in banking and finance is that they’re to be had 24/7 and may be used from anywhere. Working hours and the places of branches and ATMs are now not constraints. You can immediately meet all your banking requirements. The Mobile app banking revolution is being fueled with the aid of using new competitors.

5. Better Customer Experience

Global fintech corporations have ultimately common the significance of enhancing consumer revel in as certainly considered one among their pinnacle enterprise priorities. Fintech innovation is a warm subject matter in 2021, as people who fail to make development in consumer revel in are stuck off guard. Fintech companies must recognize how clients use Mobile apps, which advertising campaigns paintings nice for them, a way to hold their loyalty and contentment.

In the economic offerings industry, offering brilliant customer support is critical. People are leaving their banks and credit score unions for plenty of reasons, inclusive of terrible carrier and economic advice. In the lengthy run, addressing awful customer support may be some distance extra beneficial. To enhance the banking and economic offerings revel in, banks must undertake new developments and techniques.

6. Omnichannel Experience

Omnichannel is ready for a dependable and non-stop engagement among customer personalities and their monetary companies with several channels. Finance sectors can use omnichannel to now no longer most effectively meet consumers’ specific wishes however additionally count on their wishes and preferences. According to a look through Google, earlier than completing a transaction consumers commonly shift among 3 to 4 screens. An omnichannel approach allows you to apply all to-be-had advertising channels to obtain an included and seamless consumer experience. The consumer can alternate from app to internet site to social media, experiencing steady branding and messaging all through in a synchronized way.

For example – Singapore’s DBS financial institution has eliminated 11 approaches online to lessen the want for guide intervention. They skilled their body of workers on a way to use virtual tools.

7. mCommerce

In the monetary offerings industry, offering tremendous customer support is critical. People are leaving their banks and credit score unions for a whole lot of motives because of bad carrier and monetary advice. In the lengthy run, addressing terrible customer support might be a way greater beneficial. To enhance the banking and monetary offerings experience, banks have to undertake new traits and strategies with the aid of using hiring skilled fintech developers.

8. Mobile Wallet

People are the usage of virtual wallets to govern each part of their lives. A developing quantity of agencies are vying to be the go-to app for all matters finance, combining a numerous variety of payments, banking, credit, investment, and coverage merchandise right into one platform, whilst others permit customers to save crucial files and get entry to playing cards on their smartphones for regular use.

The virtual pockets category, with its substantial, attain, and regular touchpoints, is having a sizeable effect on people’s everyday lives — however handiest if new answers can supply on reliability, scale, and ease.

Users can now get entry to a substantially extra desire of economic assets and gear way to virtual wonderful wallets. They can nonetheless make payments, and they also can help with investments, mortgage applications, account tracking, and more. Wallets will play a bigger element in our economic selections over time, turning into credible advisors and dependent on assets of statistics for all thing’s money, way to effective AI-pushed analytics and customized consumer experiences.

9. Virtual Cards

A pay-as-you-go digital card is a virtual card that you deposit cash onto and use for online purchases in approximately the equal manner as a bodily card would. You can create a pay-as-you-go digital card with its very own expiration date and particular card variety through the use of our banking app.

Aside from now no longer having to fear approximately your private data being stolen or your card being lost, a pay-as-you-go digital card may be issued instantaneously, is reachable and quick, and may be used to make nearby or global online purchases.

10. Trading and Investment

Traditional brokerage corporations, funding corporations, and fintech consulting groups have all long passed online due to apps that permit human beings to make investments money. By launching the funding platform app corporations need to pioneer in unfastened buying and selling. Many inventory buying and selling corporations have visible growth in demand. They’re competing for a bigger marketplace proportion by gaining take advantage of present savings.

Conclusion:

Financial apps advanced are providing extra safety and capabilities which include voice banking, making the person enjoy conveniently. Current banking apps are clever and sufficient to help customers with nearly every monetary need, which includes percentage market, loans, invoice payments, grocery payments, and plenty extra. it Revolutionizes the Banking and Finance Industry.

If you’re making plans to construct a monetary app, the opposition is high. However, with the growing reputation of those apps, you could entice new clients by providing some USPs. For constructing revolutionary apps touch our developers.